Toccatas and Taxes: How SFCM Teaches Musicians to Handle Their Money

Stephen Crane’s financial literacy class is mandatory for freshmen at SFCM, a rarity in the conservatory world.

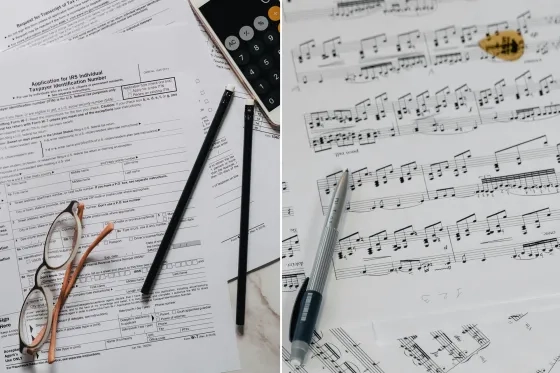

Musicians live by the notes on the page, but what about when that page is a tax form—or six?

As April’s tax deadline approaches, musicians may be sweating harder than the average taxpayer: A year in an active musician’s life can include hundreds of gigs, possibly with separate W-4’s for each one—and diverse revenue streams from teaching, recording, and social media or digital music. That’s why SFCM makes sure its students are ready to hit the ground running when they graduate.

“Every freshman is required to take Financial Literacy in their first year,” Chair of Professional Development and Engagement Center (PDEC) Kristen Klehr. “Other schools may delay this coursework towards their junior, senior year. But we really want to encourage our students to understand and be prepared to manage their financial decisions as they continue in their path.”

That’s where Steven Crane comes in. He’s taught SFCM’s financial literacy class for years, giving generations of students the tools they need to be set up for success when they leave SFCM.

“One way of looking at it is that our students need to get a return on their investment in the Conservatory,” Crane says. “So they need to have a broader package of skills and competencies than just the musical ones, and what's more critical than having the skill and competence to manage your money?”

“Money management,” though, covers a broad range. “It’s actually multiple competencies,” Crane continues. “Financial Literacy incorporates budgeting, saving money, investments, dealing with debt, managing risk, having insurance—not just for your instrument, but for you—all of these spring out of that.”

Student Natalie Boberg (violin) already had a jump-start on these skills when she arrived at SFCM. She founded her own 501(c)(3) interdisciplinary performance group with her sister, the Magari Ensemble, which organizes performances in San Francisco, New York, and Boston. But she still remembers Crane’s classes: "In our financial literacy class, Professor Crane was incredibly thorough and supportive, equipping me with skills to sustain a successful career in music through smart financial decisions. I think back to our classes and lean on his lessons often!”

Musicians who tour internationally have to be especially prepared: “If you're earning 20 percent of your revenue in the US, 30 percent in Germany, maybe another 20 percent in, let's say, Hong Kong or Shanghai, it creates huge complexity in terms of your tax liabilities,” Crane says.

One way Klehr and SFCM get a jump-start on that is with Derek Tam’s yearly visits timed, of course, to tax season. The conductor and historical keyboardist also happens to be a licensed tax professional in California and delivers a “Taxes for Musicians” seminar through PDEC aimed at answering just those complexities. "I appreciate the opportunity to provide some insight and experience into how musicians at the start of their careers can navigate our difficult tax system," Tam says. "In my lecture, we talk about the basics of being an employee or an independent contractor, and how to think of one's freelance work as being a business. I hope my visits to SFCM reduce some of the fear and worry students may have about filing taxes, which can seem so daunting."

For entrepreneurial students, the path continues up. “From Financial Literacy, students are set up to take Musical Startups or How to Build Your Own Private Teaching Studio,” Klehr adds. “And those all build on that base of knowledge: To build out a budget or apply for grants, you’ll need to have an understanding of a business model and a financial structure.”

And while the nitty-gritty of setting up an LLC vs an S-corp can get a little in the weeds, Crane emphasizes that the most basic thing an aspiring musician can do to make sure their money is sound is simply to pay attention to it. “It can be as simple as a free budgeting app on your phone,” he says. “That’s how you begin to develop an intuitive understanding of paying attention to money.” Another thing he stresses is the long-term view of what is often a cash-in-hand industry: “Musicians spend a lot of time practicing to ultimately gain these skills, and you can think about money management like that: “If I save this little amount every single month or every single week, how will it compound and build up over the long term? What kind of difference can it make to me?”

Crane isn’t a musician himself, but he’s a devoted fan of Bach and loves being around music students, calling his teaching career “soul-nourishing.” He boils it down to something much more simple than taxes: “Music is so fundamental to my life. I just want the young musicians I teach to have a successful career—whichever path they end up going down."

Learn more about SFCM’s Professional Development and Engagement Center.